If financial management is your top priority, you’re better off bypassing FreshBooks and Sage completely. FreshBooks completely lacks budget and forecasting tools, and Sage only offers cashflow projection options on its pricier, Standard tier. On the other hand, Xero’s accounting software offers a wider range of features, which makes it better for small business owners and medium-sized businesses. If you need more advanced tools, also look at Sage’s other products, Sage 50cloud and Sage Intacct. Xero, FreshBooks and QuickBooks all offer 30-day free trials and extensive features for online support, including a live chat, email support and a knowledge base. All three of these offer the ability to scale their accounting for larger businesses and both Xero and QuickBooks offer specific training for accountants.

All tracking is encrypted and secure, taking automatic security updates to keep this sensitive information private. Thankfully, there are reporting features included with both Xero and Sage. Sage is a little more difficult to maneuver, but since it has fewer features, it can ultimately be easier to learn. Xero can be knowledge information data easier to use for beginners, as it has a user-friendly layout.

Xero vs Sage: A Quick Overview

A multi-currency account that integrates with the major accounting software is one of the most wanted features for global businesses. On the other hand, Sage Accounting offers automation benefits. By linking your bank account and using the AutoEntry tool, free for the initial three months, you can automatically capture and post invoices and receipts. It’s a space where you can quote, invoice, monitor job profitability, and expedite payments. You can create unlimited projects, either for sharing with team members or for private access.

- Xero allows accountants and team members to collaborate with you through the platform in real-time.

- If you’d like a full range of features, including accounting in multiple currencies, you can shell out for the ‘Premium’ plan.

- Xero is a better solution than FreshBooks and Sage because of the strength of its overall feature offering — including its handy budget manager, decent value for money and its wide variety of integrations.

- In the battle of Xero vs. Sage, both come out on top for different uses.

- Sage also has instructional videos and webinars, but what sets them apart is Sage City—a community where users share advice and help each other.

Is Xero Right for You or Your Business?

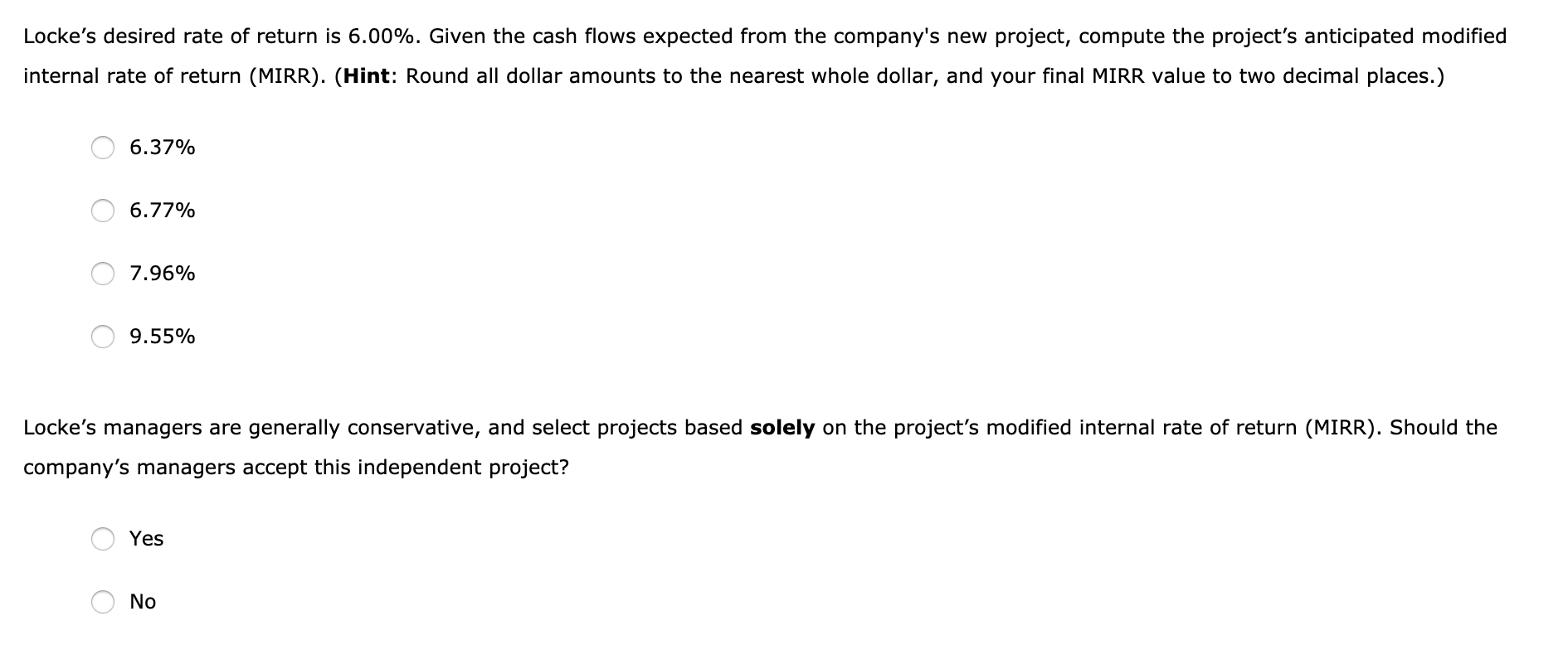

Customer service phone numbers are available for customers and partners only. Xero has three different pricing tiers, each with unique features. They’re the Early plan, Growing plan, and Established plan. They’re Pro Accounting, Premium what is a three-way match in accounts payable gep glossary accounting and Quantum Accounting. Budget is obviously a huge concern when it comes to purchasing accounting software. If you shoot too high, you’ll be using software that takes a huge chunk of your profits.

Accounting For Growing Subscription Businesses

So, let’s find out which service, Xero or Sage, is right for your business and how they can specifically serve SaaS and subscription-based businesses. We compare them based on real user reviews, prices and what features they both offer. Kristy Snyder is a freelance writer and editor with 12 years of experience, currently contributing to the Forbes Advisor Small Business vertical. She uses her experience managing her own successful small business to write articles about software, small business tools, loans, credit cards and online banking. Kristy’s work also appears in Newsweek and Fortune, focusing on personal finance.

Looking at Xero vs. Sage, you can see they stack up quite well. Because both software come with a 30-day free trial, you’ll have plenty of time to give each a test run before committing. However, there are some key features missing from Sage, including bill pay understand payroll tax wage bases and limits and time tracking.

With something as vital as your accounting software, you want to ensure that you can get help when things go awry. That’s why quality responsive customer service is so important when choosing an accounting software. Xero allows accountants and team members to collaborate with you through the platform in real-time. It’s easy to invite collaborators through the central dashboard.

Number of Users Allowed

Sage has a slight edge as it has nine invoice templates, and there’s no limit to the number of invoices you can send on either plan. Sage offers a more straightforward experience from the get-go, primarily because it has fewer features to master. However, in terms of design, it looks a bit more traditional. On the plus side, its dashboard is uncomplicated, and it shows you just the essentials. Xero offers a rich knowledge base full of articles, videos, and online courses.

Sage also makes it easy to remove access if you and your accountant part ways. Depending on your plan, Sage provides access to over 165 distinct reports. When using Sage 50cloud Accounting, you may access these reports from any device at any time. Xero provides a more in-depth expense management experience right from the start. However, the two apps can be connected via a connector app like Zapier. With Zapier, you can create Zaps (automated workflows) that connect your apps and automate tasks.